Close

Our consultation service is completely free and non-binding. We attach great importance to an intensive exchange of information in order to optimally prepare you for the purchase of your dream home in Florida.

Through our collaboration with various banks, we offer you a broad overview of financing options. Compared to a US bank, we have several options to choose from.

We can provide you with a pre-approval that gives you pre-qualification for a specific purchase price and loan amount without you having to provide proof.

Our detailed cost breakdown provides clear information on all financing and purchase costs, including capital acquisition costs, closing amounts and future monthly charges.

Our advice is individual and personal. We tailor our support to your needs and goals to ensure you receive the best advice and can make informed decisions.

We will inform you whether the project you have chosen is financeable. Through our extensive expertise, we can help you identify potential obstacles and find solutions.

Before you sign, we check the purchase contract for the financing clause included. In this way we guarantee your security and the possibility of withdrawal if there is insufficient financing.

We guide you through the entire process from application to closing. We support you with clear instructions, a checklist for required documents and a dedicated team.

A mortgage loan you obtain to purchase a property (house, condominium, commercial building, etc.). The lender provides the funds to the seller on your behalf, and you repay the loan with interest over time. These are usually annuity loans, with a fixed or variable interest rate, depending on your preference.

In Florida, construction financing runs from the start of construction to the end of construction, so it is strictly speaking interim financing. Payment is made in accordance with the contractually agreed construction phases. Commitment interest is not charged. Interest only accrues on the amount paid out. Upon completion of construction, a “mini” closing occurs, during which the final installment is paid to the construction company. This mini-closing marks the beginning of the final financing, and only then do regular interest payments for the remainder of the term take effect.

This represents a classic refinancing. In Florida, you choose this type of financing if you have an existing loan but want a better interest rate, a different term, or a completely different loan model. The new loan is paid out simultaneously with the deletion of the old mortgage.

A Lombard loan is a secured loan in which the borrower pledges valuable assets, such as securities, precious metals, etc., to the bank as collateral. This allows them to quickly obtain liquidity without having to sell their assets or mortgage the property. PTF offers this in various currencies (USD, EUR, GBP, and CHF).

These are land registry-backed financing options offered for commercial properties or residential properties with more than four residential units. These include, for example, apartment buildings and office buildings, residential complexes, shops, warehouses, etc.

Financing for companies based on their sales and profit figures, without the involvement of potential real estate or land registry security. We offer this for American subsidiaries of parent companies located in Germany.

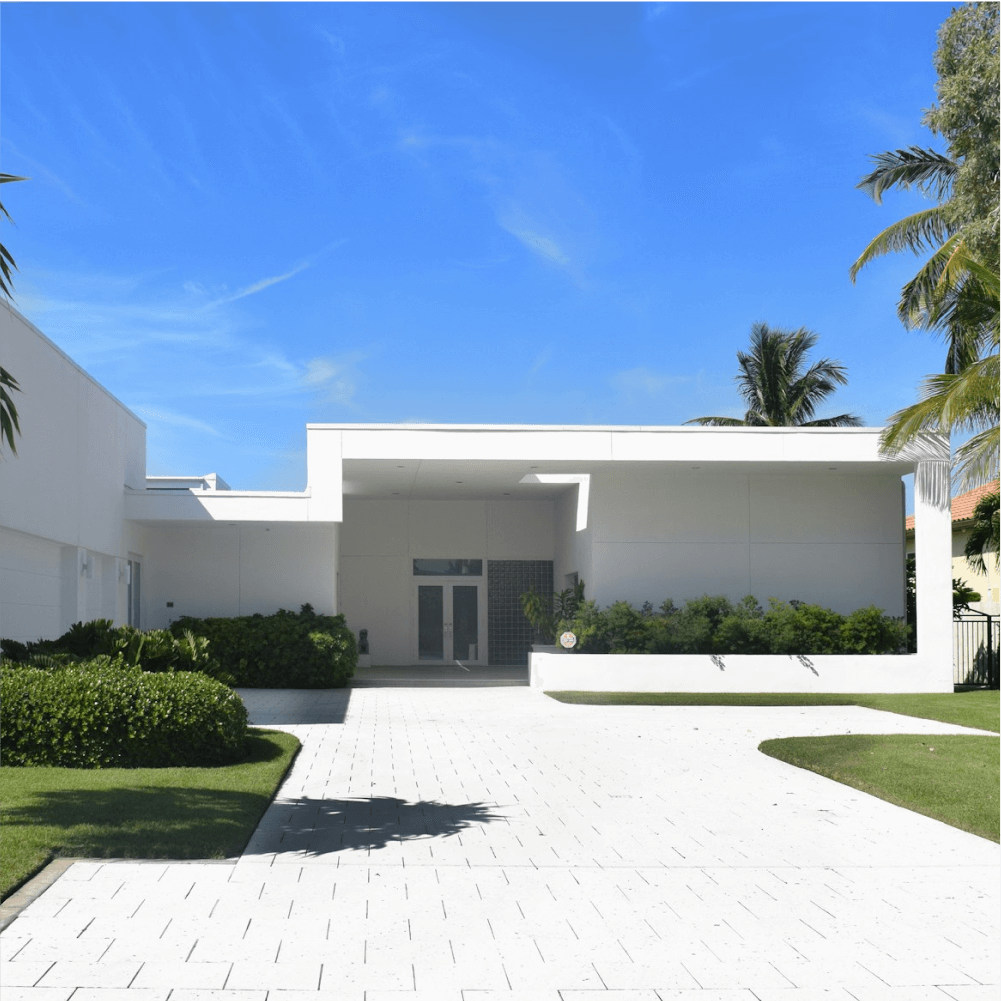

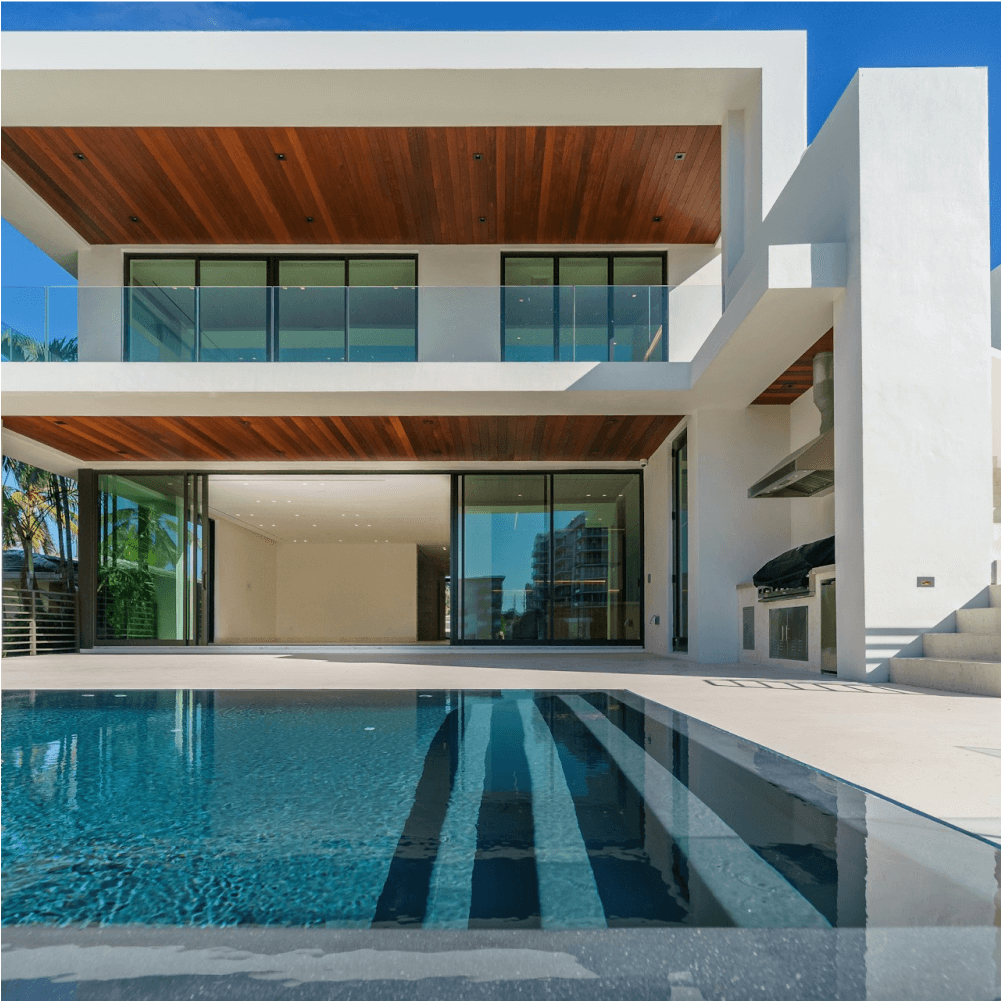

In collaboration with experts from our extensive network, Paul International offers comprehensive real estate consulting for investors looking to enter the US property market or expand their existing US portfolios. Together with the experts in our network, we provide market analysis, identify prime investment opportunities, and offer strategic recommendations tailored to your individual needs. Our broad network grants you access to exclusive deals and in-depth market insights, enabling you to make well-informed decisions.

At Paul International Consultants, we understand that investing abroad entails complex legal challenges. Partnering with our network of international lawyers, we assist you in safeguarding yourself and your financial ventures in the USA. This includes contract drafting, real estate law, tax law, corporate law, estate law, immigration law, and other areas such as document review, compliance, and deadline management. This ensures that all legal aspects of your investments and business activities comply with American laws and regulations.

Paul International Consultants boasts a robust network of international tax advisors. This is indispensable because our tax advisors are well-versed in the specific tax laws and regulations of various countries and assist in their correct application to avoid legal issues. This gives you direct access to matters such as double taxation and allows you to plan your tax affairs in your own language and across borders. Our tax advisors help you navigate complex international business and investment structures, taking advantage of tax benefits. With our network, you have a solid foundation for a legally compliant and transparent handling of all tax matters.

Moving to a new country is a significant challenge that requires thorough planning and preparation. Paul International Consultants has an extensive network of immigration attorneys specializing in this major step. Whether it’s immigration or non-immigration visas, work permits, green cards, understanding the pros and cons… Whether you’re buying an existing business, entering into employment, or establishing a subsidiary for your company abroad, there are numerous possibilities and approaches. We have the experts who can tell you what matters, what you need to watch out for, and what your personal options are.

Paul International Consultants collaborates with the best insurance agents to provide you with professional and personalized advice to adequately protect and insure your property. The insurance sector has undergone many innovations and changes in recent months and years. There are still property owners who have not sufficiently or even at all insured their assets — a critical oversight. Get informed in time; we offer you the best contacts. Our expert team helps you identify and secure the right insurance policies for your needs.

Get to know us and our dynamic team at Paul International Consultants better. Learn more about our mission and how our team provides you with world-class financing solutions.

Ready to take the first step towards purchasing real estate? Fill out our application form now and let us make your dream of owning your own home a reality together!

Do you have any questions or need individual advice for your real estate financing? Request personal advice now and let our experts support you.